| By Gale Staff |

More and more states around the United States are implementing financial literacy requirements in their high school curricula—and for good reason. Studies show that courses dedicated to financial literacy lead to students making more positive financial decisions for their futures. Coursework integrates critical lessons around managing student loans and lowering credit card debt, and financial literacy topics often include education around smart investments and savings techniques, which are advantageous for any young adult to understand.

April is National Financial Literacy Month. Whether or not your state mandates personal finance within its curriculum, you can observe the holiday by creating valuable lessons for your students. Defined as your ability to effectively understand and use financial skills, the term financial literacy encompasses personal financial security as well as investment opportunities. This is a rich, sometimes complex topic, but Gale In Context: High School can help break it down for your students. Gale’s resources are curated for high school learners. Plus, educators will find helpful tools to reinforce their lesson plans.

Create a Personal Budget

One of the best ways to begin your financial literacy lesson planning is with a personal budget activity. Gale In Context: High School features helpful entries that define a budget and even provide visual examples and case studies. A budget can help you spot certain trends in your spending, identifying areas you can save more money. Budgeting is simple, but it’s a skill that gives people a better sense of control over their finances.

Activity Idea: Have your students create their budgets. Ask them to write a list of all of their monthly expenses plus any income or allowance they have coming in. Do their budgets balance? Is there any leftover for savings each month? Introduce helpful budgeting apps that students can easily access via their smartphones.

Plan for College

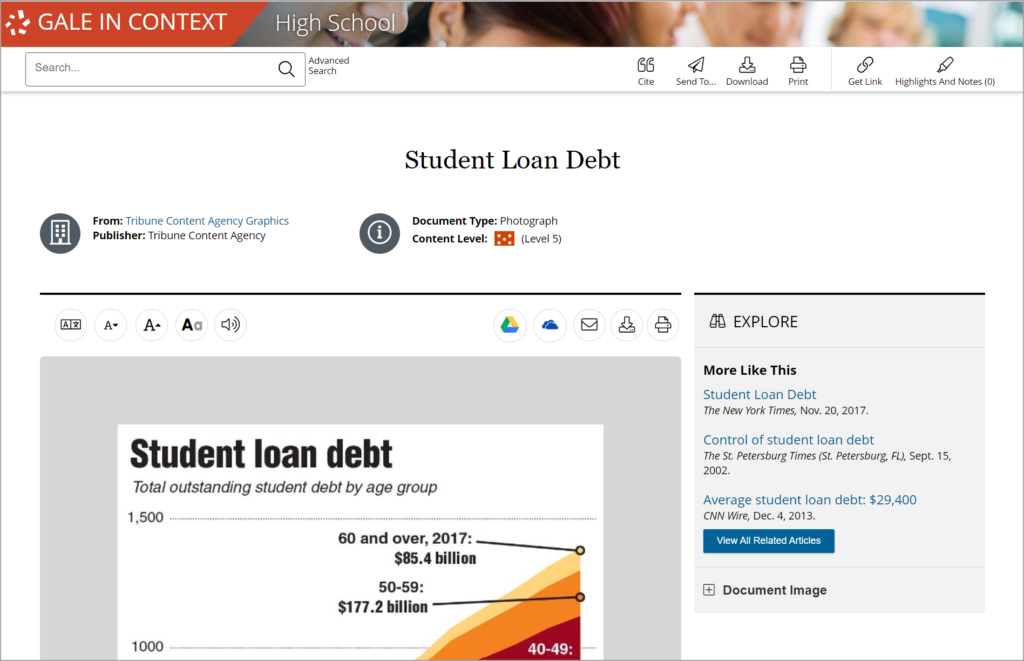

Student loan debt is one of the biggest concerns for young people, especially those who hope to attend college after graduating high school. Not every student has parents who can support their college goals, and undergraduate education is a significant expense. With Gale, you can help your high schoolers develop a better understanding of student loans and interest rates and teach them how to avoid predatory agencies. Gale provides helpful tips for saving for college and breaks down key terms like “FAFSA” and “repayment.”

Activity Idea: Have students research the average tuition of the college they hope to attend. Gale’s college saving overview has a direct link to a special calculator that helps your students estimate the cost.

Destigmatize Financial Conversations

Too often, people are uncomfortable talking about their finances. But if parents aren’t having these important conversations with kids, then the responsibility falls on schools to set students up for financial success. Teachers can help normalize financial conversations. Students don’t need to discuss their financial situations, but they can access hundreds of articles and media at their reading level. Once students feel more confident with the vocabulary and concepts, it will be easier for them to discuss personal finance in the future.

Activity Idea: Have students listen to a podcast about personal finance. Ask them to share something they learned with the class. Exercises like these can help students practice having conversations about money.

Integrate Current Events

A big piece of financial literacy is the ability to read information about finances and the economy and understand it. However, outside of math or economics, there aren’t many spaces where students will get the chance to learn terminology like “interest” or “credit.” When will students be taught what a “mortgage” is? What’s the difference between a 401K and an IRA? The financial sector is riddled with challenging vocabulary, acronyms, and numbers. Gale In Context: High School helps simplify the lingo, even separating difficult words within a “Words to Know” sub-section (if only every article you read would do that).

Activity Idea: Take a look at some of the recent stories trending about American finances. Have your students select a current article from a major publication — do they understand what the article is about? Encourage them to make a list of any terms with which they are unfamiliar and look them up in the dictionary. Read the article again and draft a simplified summary to share with the class.

Make personal finance education easy for students with help from Gale In Context: High School. If your school doesn’t already subscribe to Gale, learn more about High School or request a trial.